Posted on February 10, 2023

- Affirm reported poor results for the quarter ending in December.

- AFRM stock lost 19.1% afterhours.

- Affirm will trim its workforce by 19%.

- Higher interest rates are hurting Affirm’s lending model.

Affirm Holdings (AFRM) stock got pummeled afterhours for its fiscal Q2 2023 earnings miss late Wednesday. The Buy Now Pay Later (BNPL) stock lost 19.1% afterhours to trade down to $12.96 after losing another 6.9% in Wednesday’s regular session. Misses on both its top and bottom lines had the stock losing much of its January rally, which at its range high had seen AFRM stock up more than 100% for the year.

Affirm stock earnings: Lending firm to layoff 19% of workforce

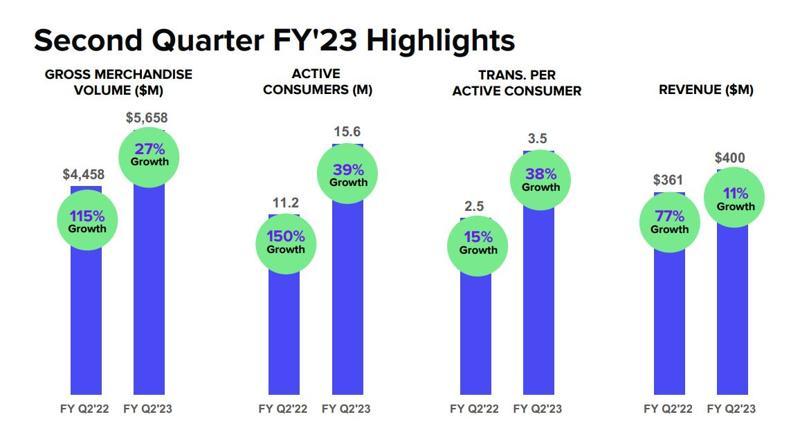

Affirm reported an earnings per share loss of $1.10, more than 15% worse than the expectation for $0.95 a share. Revenue of $400 million also missed the Wall Street consensus of $416 million and was due to gross merchandise revenue of $5.66 billion falling short of expectations.

“Revenue was at the low end of our expected range and adjusted operating income came in better than expected,” said CEO and founder Max Levchin, well-known as an early executive of PayPal (PYPL). “On the other hand, gross merchandise volume was short of expectations as was revenue less transaction costs as our mix shifted to more interest-bearing loans and we retain more loans on the balance sheet.”

Levchin said that Affirm had grown too quickly when revenue was growing extremely fast during the covid pandemic, but now that the Federal Reserve was lifting interest rates rapidly the company was seeing a sharp drop-off in revenue growth. The higher borrowing costs for Affirm also meant that it needed to streamline the company by cutting its workforce by 19% or about 500 jobs.

What is worse is that Levchin and other Affirm executives see the situation growing worse. Affirm is now guiding revenue for the next quarter at a mid-point of $370 million, well below the $418 million expected by Wall Street. Gross merchandise revenue of $4.45 billion is also far below expectations of $5.275 billion. For the full year, Affirm expects revenue of $19.5 billion rather than analysts’ forecast of $20.6 billion.

Source: Affirm Holdings

Affirm stock forecast

Affirm stock’s sell-off has put it nearly right in line with the January 2023 low, which shareholders are hoping acts as support. The 4-hour chart below shows how far AFRM stock came in January. At its zenith on February 2, AFRM stock was up more than 135% for the year, so a major fall on bad earnings news is not all that surprising. January pushed many loss-making growth stocks well ahead of the market, and now comes reality. That reality will likely push Affirm stock down to support at $12 or even more like to the demand zone that stretches from $8.63 to $9. With interest rates likely to keep mounting, do not expect Affirm to have a second run like January in the first half of the year.

AFRM 4-hour chart

The post Affirm Holdings Stock Earnings and Forecast: AFRM drops 19% on earnings miss appeared first on .