Posted on October 27, 2022

- We Are Under Pressure To Perform – Loan App Staff Cry Out

- Between Unpaid Loan By Customers and Loan Apps’ Staff Sending Shame Messages To Them And Their Contact List

- Top 6 loan apps in Nigeria that have exceeded 500k reviews, 5 million downloads (As of Q4 2022)

- Top 6 loan apps in Nigeria that have crossed 100k reviews and 5 million downloads (As of Q4 2022)

- Below is an analysis of Top 6 loan apps in Nigeria that have crossed 100k reviews and 5 million downloads (As of Q4 2022)

- S /No.

- Application Name

- “Best For” Pick

- Number of Downloads

- Number of Reviews

- Frequently Asked Questions FAQs About Loan Apps In Nigeria

The issue of digital lending platforms in Nigeria terrorising and threatening customers and borrowers has been a re-occuring one in last few months as a result of their unethical loan recovery practices. A situation where a loan app is seen using and sending defamatory and shame messages to its customers, their family members and their contact list has become very rampant but quitedemeaning and unacceptable. Also the unrelenting expository efforts of Nigerian and indeed African No 1 review blog for loan apps, QUICK LOAN ARENA has also been on the outlook with the reference platform coming up with different interventions to nip this ugly trend in the bud.

Efforts have been made to alert the government and other regulatory bodies and stakeholders on these unethical practices and it seems a lot still has to be done. QUICK LOAN ARENA is also employing the government to look into the rules of engagement adopted by these lending platforms in their loan approval and repayment strategy. Shame messages to borrowers are causing heartaches and resulting in emotional torture.

We Are Under Pressure To Perform – Loan App Staff Cry Out

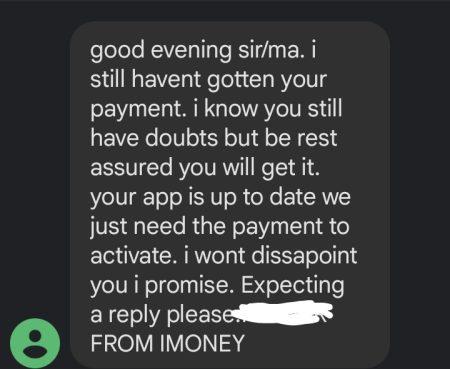

A staff (name withheld) of iMoney, one of the lending platforms in Nigeria told QUICK LOAN ARENA that if a customer he is attached to fails to make his repayment by 8am on his due date, three thousand Naira (N3,000) would be deducted from his salary in that month and he may be consequently sacked. This he revealed in a message he sent to one of our investigative journalist. SEE MESSAGE BELOW!

Between Unpaid Loan By Customers and Loan Apps’ Staff Sending Shame Messages To Them And Their Contact List

According to customers of these digital lending companies, the rash shame messages and malicious languages employed by these staffs all the time suggest they are under undue pressure too to get the loan repaid.

The question now is, is it proper by any standards to be subjected to this kind of savaging condition for working for working for loan app company? We hope that the relevant authorities will also look into these areas and protect Nigerian workers too with appropriate laws and rules of engagement.

Top 6 loan apps in Nigeria that have exceeded 500k reviews, 5 million downloads (As of Q4 2022)

Find below the top 6 loan apps that have exceeded 500k user reviews and feedbacks and have been downloaded for up to or more than 5 million times on Google Play Store as at the beginning of Q4, 2022.

- Branch Loan App — (10 million+ downloads)

- FairMoney Loan App — (5 million+ downloads)

- Palmcredit Loan App — (5 million+ downloads)

- Okash Loan App — (5 million+ downloads)

- PalmPay Loan App — (5 million+ downloads)

- Carbon Loan App — (1 million+ downloads)

Top 6 loan apps in Nigeria that have crossed 100k reviews and 5 million downloads (As of Q4 2022)

Find below the top 6 loan apps that have exceeded 500k user reviews and feedbacks and have been downloaded for up to or more than 5 million times on Google Play Store as at the beginning of Q4, 2022.

- Branch Loan App — (10 million+ downloads)

- FairMoney Loan App — (5 million+ downloads)

- Palmcredit Loan App — (5 million+ downloads)

- Okash Loan App — (5 million+ downloads)

- PalmPay Loan App — (5 million+ downloads)

- Carbon Loan App — (1 million+ downloads)

Below is an analysis of Top 6 loan apps in Nigeria that have crossed 100k reviews and 5 million downloads (As of Q4 2022)

S /No. |

Application Name |

“Best For” Pick |

Number of Downloads |

Number of Reviews |

| 1 | Branch Loan App | Top Overall Lending Platform in Nigeria | (10 million+ downloads) | 800,000 Reviews |

| 2 | FairMoney Loan App | Best for Highest Loan Tenure | (5 million+ downloads) | 497,000 Reviews |

| 3 | Palmcredit Loan App | Best for Flexible Repayments | (5 million+ downloads) | 176,000 Reviews |

| 4 | Okash Loan App | Best for Multiple Financial Products | (5 million+ downloads) | 104,000 Reviews |

| 5 | PalmPay Loan App | Best for Banking Services | (5 million+ downloads) | 261,000 Reviews |

| 6 | Carbon Loan App | Best for Building Credit Score | (1 million+ downloads) | 133,000 Review |

Frequently Asked Questions FAQs About Loan Apps In Nigeria

Which app gives loan without debit card in Nigeria?

The following are the loan apps without debit card in Nigeria:

Branch

Aella Credit

Quick Credit

FairMoney

Umba

Renmoney

OKash

GTB Quick Credit

Money in Minutes

Quick Check

Can I get loan without ATM card in Nigeria?

Yes you can get a loan without ATM Card in Nigeria.

An ATM card is not mandatory condition to obtain a loan. In fact many micro-lending companies and loan apps do not require a debit card or an ATM card for loan. Once you can show that you have the capacity for repayment, either by your credit history, your present salary or your analysis of your bank statement, many of the loan apps will oblige you a loan. All the loan apps stated above will give you credit without a debit card.

Which is the best app to get instant loan on apps without debit card in Nigeria?

Below is a list of the top best apps to get instant loan without debit card in Nigeria: Please note that this rating is subject to review from time to time.

1. Branch

2. Carbon

3. Aella Credit

4. QuickCredit

5. Money in Minutes

6. FairMoney

7. Page Financials

8. Renmoney

9. Umba

10. Okash

11. QuickCheck

12. Migo

13. Zedvance

14. C24 Capital

15. GTB Quick Credit