Posted on October 2, 2022

- How does Money Lending Apps Work?

- Step-by-Step Process to Create a Money Lending App

- What are the Key features of a Money Lending App?

- What are Legal Compliances and Encryption?

- How Much Does it Cost to Build a Money Lending Application?

- How to Promote Your Money Lending App?

- What are the Popular Examples of Money Lending Apps?

- We can Build a Bespoke Money Lending App for You

- Conclusion

- FAQs on Money Lending App Development

- Step 1: Verify your Planned Loan Application

- Step 2: Create a Project Plan & Requirements Document

- Step 3: Choose an App Development Partner

- Step 4: Create an MVP

- Step 5: Discover Products First

- Step 6: Create a UX design

- Step 7: Create Lending Application UI Design

- Step 8: Conduct User Testing

- Step 9: Create an App Development Life Cycle

- What is a platform for online lending?

- Can I use an existing mobile app for my loan application?

- Can I create an app for a lending platform that exists now?

- What resources do I require to develop a money lending application?

Money lending apps bring together those looking to borrow money and those ready to lend it. Lending money has always been important to societies throughout the world.

The need for this kind of service, particularly in recent years, has increased dramatically due to millions of individuals losing their jobs and income due to the pandemic. They seek beneficial borrowing methods, and peer-to-peer lending platforms are one particularly well-liked option.

Is the long-term investment worthwhile in this market segment? Let’s quickly review some statistics:

According to grandviewresearch, the digital lending platform market size was $5.84 billion in 2021. It is expected to have a compound annual growth rate (CAGR) of 25.9% between 2022 to 2030.

As per lendingtree, more than 84% consumers use peer-to-peer payment services.

If we look at the alternative lending market, it comprises diverse loan options in addition to traditional bank loan options. This enormous figure amply illustrates the possibilities for investing in money lending app ideas.

Be with us till the end to learn critical details about developing a loan app and how peer-to-peer lending applications function. Go through the features that these apps need to have as well as the stages of developing money lending mobile apps for iOS and Android.

But before that, let’s start with some basics.

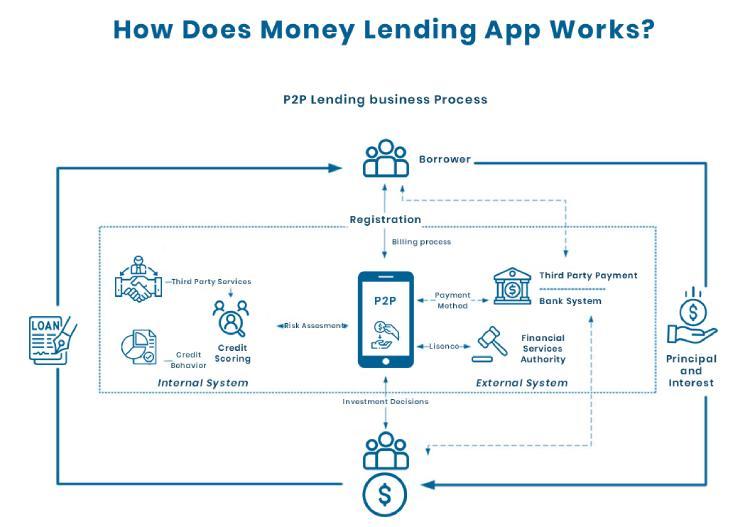

How does Money Lending Apps Work?

There are several advantages to money lending. However, one of the main advantages is that there are no middlemen like banks or loan brokers. As equal parties, lenders and borrowers can bargain directly over loan terms, including interest rates and repayment schedules.

Following a security check, the platform accepts the borrower’s loan application. Once the list of loan applications is managed, the lender can decide which ones to approve. The platform earns revenue by keeping a portion of each loan, charging a subscription fee, or in any other way, but since there are no middlemen, all users are guaranteed fair interest rates and terms.

Want to create a money lending app but don’t know where to start? Get a free consultation from our experts.

Let’s Discuss

Step-by-Step Process to Create a Money Lending App

We have put up a concise guide that walks you through the process of writing a loan application step-by-step.

Step 1: Verify your Planned Loan Application

Before creating a money lending app, you must first test your idea. Research the market and competing products. Take a poll of the intended audience. Find out what they think the program is missing, what features will be helpful, what matters to them, what they want included, etc.

It will be simpler for you to begin a loan application with more information you can gather now. Remember that you are creating a product for consumers. As a result, you should consider what they think.

Step 2: Create a Project Plan & Requirements Document

Create a thorough development plan for your product next. You must list each action you take. Building a successful money-borrowing app requires a clear strategy since order and consideration help keep everything in check.

Make a list of the specifications for your following product as well. Using this document, you and your team will constantly be aware of what needs to be done to ensure that the final result fulfills your original intentions. The following are typically found in the design and development requirements (specifications) document:

- Complete project overview

- Principal aims and needs

- Target market

- Functional specifications and the intended feature set

- Aesthetic features

- Details that aren’t functional

- Prohibitions and recommendations

- Questions

Step 3: Choose an App Development Partner

The following stage is to choose a dependable partner. Finding a good team to create a fantastic product and launch a loan app may be done in a few different ways:

Utilize social media: For instance, you can locate agency and representative profiles for design and development on LinkedIn. Examine their background, primary fields of employment, past clients and projects, etc.

Utilize B2B sites: For instance, you can find numerous design and development teams, the projects they’ve worked on, client endorsements, and more on the Clutch & GoodFirms website.

Partners and Coworkers: Find out how your coworkers, business partners, or friends like to operate in teams. They might be able to recommend a top design and development team for you.

Contact Guru TechnoLabs: We are always up for innovative and exciting initiatives. We will be delighted to go over the specifics of your project. Reach us here

Step 4: Create an MVP

It’s advisable to start with an MVP when you feel ready to design a loan lending mobile app. This deliberate action can help you avoid wasting a tonne of time, energy, and even money. A minimum viable product will highlight any slip-ups and errors you may have made while working.

Even an app with all the necessary features is just a starting point for further development. However, you may already predict how your potential users will react to your software at this point, delve into their demands, identify its strengths and limitations, and even keep the first clients and make money.

An MVP makes a fantastic base for your loan application’s final edition. Once this draught has been refined, you are prepared to confidently enter the market and go forward with the fewest possible risks and losses.

Feel free to reach out to us to develop an MVP version of your money lending application.

Contact Us

Step 5: Discover Products First

Drawing up the business case for your product and reviewing competition research will assist you in developing a solution that will exceed those competitors’ offers. Determine the issue your product will address, whether customers will purchase and use it, and the viability of your solution.

The more data you gather and prepare for at this point, the simpler it will be for your design and development team to comprehend the type of product they must make. Additionally, it will raise your chances of coming up with a handy answer.

Before creating a money lending app, you need to conduct a business study. Business analysis is a thorough evaluation of the chances of commercializing a new product about the initial expenditure. Simply said, a business analysis enables you to determine the profitability of a new product’s development, how quickly it will pay off, and how much revenue it may provide.

Step 6: Create a UX design

Start creating a UX design after that. How can a user-friendly lending app be created? For any mobile application, UX is essential. Here are the first six steps to good UX design:

Examine the users: The first step is to identify the target audience for your app. There are many ways to find out more information about your users. Analyses of both quantitative and qualitative data and comments are combined.

You can only make a successful design for your consumers if you comprehend their objectives, demands, and preferences.

Establish situations: The next stage is to clearly define the goals you (or your consumers) have based on your research. Make the ideal trip plan for your client and note any potential obstacles. Describe as many scenarios and applications for your product/service.

Create a concept: Start brainstorming after gathering all the facts gathered. Create a storyboard or mood board to communicate the issue you are attempting to solve visually.

Establish a prototype: Even before the development stage, prototyping is the most efficient technique to make your concept come to life. Create a paper mock-up of the interface with all its crucial elements, and then request as many replays of the script as possible. You will be able to see any unanticipated user behavior or potential impediments thanks to this method.

As needed, repeat the instructions: You might need to return to the idea stage and find other alternate options depending on the outcomes of your testing. The UX design process is iterative, meaning some functions must be repeated to produce the intended result.

Want to Create a Prototype for Your App?

Share your project requirements with us. Our team will brainstorm and develop a user-friendly prototype of your money lending app.

Let’s Talk

Step 7: Create Lending Application UI Design

How can I create a loan application that customers find visually appealing? The goal of the UI is to create a positive user experience. Create a user-friendly and feature-rich UI design for your lending app. Every component a user interacts with can be seen as part of the user interface.

Step 8: Conduct User Testing

How can a loan application be created without flaws and bugs? When your UX/UI is prepared, you must adequately test everything. Testing will enable you to spot faults and other issues early on and address them quickly. Additionally, testing will assist you in determining how user-friendly and understandable your design is.

Step 9: Create an App Development Life Cycle

The most critical part is about to start. To move toward launching a loan application, you must translate the concept into a genuine, functional product. The entire development process is divided into various parts. Here we will look at all of these parts in brief.

Technical Specifications for Products

To create a product that meets the expectations and requirements of the customer, all pertinent information from the client is gathered during this phase. The group should select technical stacks and develop technical documentation.

The team should also establish the functionality needs (requirements for the admin panel) and user roles at this time (admin and super admin). The team should finish the estimate and scope of work.

Development

Software developers build the code for the components using the architecture and documentation from earlier processes. We allocate the work to the team members depending on their area and level of expertise.

Testing

QA engineers test all provided code, and component manual testing is also done.

Installation and Integration

The team proceeded to production deployment and integration once the QA team completed its development and regression testing.

Users can access the product’s tested version for doing beta testing. The group gathers user input while also implementing some changes and issue fixes.

Launch

The market should see your stuff right away! To make your product reaches the products in the best possible manner, you should plan your launch process and execute it properly.

The primary stages of launching a loan application are as follows:

- Determining the target audience.

- Production of distinctive product packaging.

- Create a slogan and a timetable.

- Competition research.

- Establishment of customer onboarding.

- Building a website & mobile application.

- Advertising.

Maintenance

The development team is in charge of a product’s maintenance after being used in a production setting or if any problems arise that need to be rectified or enhancements that need to be made.

Guru TechnoLabs is a leading web & app development company. We have delivered a wide range of mobile apps to clients globally. If you need help with your money lending app idea, contact us. Our experts provide free consultation along with the quote.

Contact Us

What are the Key features of a Money Lending App?

Your product needs to be easy to use, user-friendly, with a slick UI and precise interactions like Lending Club for it to be successful. It must offer a smooth experience for consumers, lenders, and borrowers alike.

Let’s look at the fintech apps’ essential features.

Registration/login

It must be possible for users to register for an account and sign in with their Facebook account, phone number, or email address. Additionally, users must provide their contact information, which the site will verify.

Managing loans

Users should be able to see information such as the Tax amount, loan EMIs, platform processing fees, etc. Furthermore, borrowers should be able to create and publish loan applications, select the timeframe for repayment, and communicate with lenders about different aspects of the loan application process.

Billing and payment

A history of all payments should be kept in the loan app so that the lending process can be seen in complete transparency.

Purchases and EMIs

To repay the loan, a borrower must make EMIs that include interest and principal payments. For the convenience of an audit and future reference, these transactions should be kept after the loan has been entirely repaid and all EMIs have been paid.

Withdrawals and transfers

Direct bank account or debit card withdrawals should be possible using the money lending app. There are numerous other features that a loan app can perform in addition to these.

Ratings and reward points

Borrowers and lenders might be regarded as reliable partners for upcoming transactions by accruing points for promptly fulfilling their obligations.

Individual reporting

The app must provide information for all parties, including the number of loans open for each user, the number of EMIs paid, and the number of EMIs still due.

Chatbot

Adding a chatbot can be a helpful strategy to introduce new users to the app’s features and teach them how to use it.

Analytics based on AI

Real-time analytics offers great benefits to users as well as admins. Lenders can look after the potential borrowers’ credit histories and KYC details. To get valuable insights and enhance user experience, platform administrators can access extensive analytics on various platform operations.

The more cutting-edge features you use, the more you stand out from rivals. Launching a profitable MVP requires understanding which elements are essential and which are merely good to have.

Let us know about your project requirements. Our app developers will<\/br> integrate the latest features as per your needs.<\/p>”,”tablet”:”

Want to integrate AI\/ML or any other innovative features?<\/span><\/p>\n

Let us know about your project requirements. Our app developers will integrate the latest features as per your needs.<\/p>”}},”slug”:”et_pb_text”}” data-et-multi-view-load-tablet-hidden=”true”>

Want to integrate AI/ML or any other innovative features?

Let us know about your project requirements. Our app developers will integrate the latest features as per your needs.

Let’s Discuss

What are Legal Compliances and Encryption?

These subjects must be discussed individually since they are crucial to operating legally and avoiding difficulty. You must also safeguard a loan application and website to stop hacker attacks.

Tolerance for faults must be ensured

Your peer-to-peer lending system must be fault-tolerant. Therefore, it must be considered by developers. It suggests it will keep working even under a heavy load caused by several simultaneous operations. Therefore, developers need to use a unique tool to handle fault tolerance.

Prioritizing security

Your mobile app and website should both be sufficiently secure, and you should guard against the most common threats like XSS (cross-site scripting), SQL injections, the exposure of sensitive information, faulty authentication, and others.

All User and Lender Personal Data collected from a Third Party shall be encrypted using any current encryption methods and signature technology. Additionally, PINs, passwords, and even biometric verification should be employed for encrypted permission across the board. As a result, it’s essential to pay particular attention to the security issue in this instance.

GDPR adherence

To develop software for the EU market, you must ensure that your lending application complies with GDPR. The General Data Protection Regulation, or GDPR, went into force on May 25, 2018.

Remember that local laws and ordinances may change depending on where you intend to develop a P2P lending app.

How Much Does it Cost to Build a Money Lending Application?

The cost to build a money lending app starts from $25,000 and goes up to $50,000 or more. The cost varies based on your required features. The development costs of your lending app will undoubtedly go down if you do your homework and carefully explore off-the-shelf SDKs.

Various factors affect the cost of building an app for loan lending. Even if the application development company has chosen to construct a loan app, you should consider the following elements significantly affecting the development cost.

- The application’s complexity

- UI/UX of an app platform

- The number of characteristics it has

- Architecture for application

- App development timeline

- Developer location & experience

Several factors, such as where you are in the app development process and the functionality you desire, might affect how long it takes to construct your app.

Our executive will understand your project’s needs well and provide<\/br> a free quote for your money lending app idea.<\/p>”,”tablet”:”

Want to Know the Cost of Your Money Lending App?<\/span><\/p>\n

Our executive will understand your project’s needs well and provide a free quote for your money lending app idea.<\/p>”}},”slug”:”et_pb_text”}” data-et-multi-view-load-tablet-hidden=”true”>

Want to Know the Cost of Your Money Lending App?

Our executive will understand your project’s needs well and provide a free quote for your money lending app idea.

Get a Free Quote

How to Promote Your Money Lending App?

How well you advertise your application is now the question. How will you promote your mobile application? Here are three approaches to encourage your P2P money lending app in response to your queries.

App promotion with landing pages

Create a landing page with an easy-to-navigate layout and exciting information to maximize conversion for your lending app. A website is crucial to getting quality leads for your money lending app. To gain the most exposure from users, create a landing page that is straightforward yet accessible.

Use of social media

Globally, 4.58 billion people utilize social networks. Furthermore, by 2022, 65.3% of Americans plan to use digital banking. You can advertise your money lending app on sites with a more extensive user base, such as Facebook, LinkedIn, and YouTube.

Content Promotion

89% of respondents to a study of global marketers conducted in the middle of 2019 said that content marketing is already employed as part of their promotional operations. To advertise your brand and software to the consumer, create blog posts, use video marketing, and write eBooks.

What are the Popular Examples of Money Lending Apps?

Here are some of the best money lending apps in the USA.

Earnin

Earnin is a paycheck advance app that allows you to borrow the money you’ve earned while keeping track of your working hours using a timesheet or location monitoring. The app also alerts you when your bank account balance is low and offers to top it off for a fee.

Download for Android & iOS

Dave

You can use the Dave app to borrow a small sum of money to pay bills while you wait for your next paycheck or stop your bank account from going overdrawn. Loan amounts are higher for users who have Dave spending accounts than for those who don’t.

Additionally, the app offers a “Side Hustle” feature that aids users in finding side jobs to increase their income.

Download for Android & iOS

Brigit

With the budgeting app Brigit, you get access to up to $250. The app’s free plan, which provides budgeting assistance and financial guidance, is available for usage.

With the premium plan, you get access to all the benefits of the free plan plus cash advances, automated transfers into your account when you’re close to overspending, and credit monitoring, to receive the cash advance.

Download for Android & iOS

Chime

is a mobile startup that provides checking and savings accounts as well as credit-builder loans.

In the case of traditional banks, customers have to wait for two days before the money gets deposited in the bank account. But with a chime, you can instantly get a chance to use the money.

The app also offers the SpotMe function to customers to overdraw their checking accounts by a small, predetermined amount without incurring fees. SpotMe still asks if you want to tip even though it’s more of an overdraft protection feature than a cash advance.

Purchases that would lower your account balance below the additional cushion get automatically rejected by Chime. Your account can go negative up to your allowed amount. To be eligible for SpotMe, you must receive at least $200 in qualifying direct payments into your Chime account each month.

Download for Android & iOS

MoneyLion

A credit-building loan, cash advances up to $250, financial tracking, mobile bank and investment accounts, and the MoneyLion app are all available. Anyone with a qualifying bank account is eligible for the Instacash advance.

However, if you require your money right away, you will have to pay a fee. Although MoneyLion claims there are no fees or interest associated with the cash advance, you may be requested to leave a tip if you accept one.

Download for Android & iOS

We can Build a Bespoke Money Lending App for You

Guru TechnoLabs helps to design money lending mobile app with legal considerations and compliance issues all covered. In addition, you now know the answer to the commonly asked question about the cost, features, and examples of developing a loan application.

Additionally, this site includes FAQs to assist you in fully comprehending detailed facts regarding the money lending application.

The process of developing a loan app is laborious. But if you stick to these instructions, you’ll undoubtedly be able to design a successful bespoke loan app for your FinTech firm.

Contact our IT consultants to validate your idea and help your business grow.

Conclusion

If you want your app to sustain in the mobile industry for a long time, then you should focus on allocating an appropriate budget for mobile app maintenance.

To maintain your app efficiently for a long period, you should give its responsibility to a leading mobile app maintenance company like us.

We have a highly-experienced team of professionals who follow the latest industry trends to maintain mobile applications belonging to any industry.

Share your project requirements with us and we will provide you with a free quote.

FAQs on Money Lending App Development

What is a platform for online lending?

Any loan not obtained directly from a conventional bank comes through an “internet money lending platform.” They are typically viewed as a quicker option than traditional banks.

Can I use an existing mobile app for my loan application?

Making your loan product accessible via mobile web browsers may give customers a mobile experience. You may potentially create a PWA loan app as an alternative. Without a doubt, native apps can provide your users with a fantastic experience.

Can I create an app for a lending platform that exists now?

You would have to talk about the conditions with the platform’s proprietors. You can’t create a loan app at your discretion and expect a lending platform to accept it. You’ll need access to its API to integrate your app with the platform.

What resources do I require to develop a money lending application?

A group of full-stack fintech developers is ideal, including UX/UI designers, back-end developers, DevOps engineers, QA engineers, and mobile developers. Oh, and a project manager to get everyone on the same page.