Posted on September 20, 2022

Interest still robust despite hurdles

Geopolitical risk, inflation and banks’ focus on environmental criteria are creating headwinds to developing more natural gas liquefaction capacity at LNG terminals in the US, although commercial support for new gas export terminals remains robust.

Terminal developers Cheniere and Venture Global have this year authorized final investment decisions behind separate projects that will bring more than 23 million mt/yr in additional liquefaction capacity to the Gulf by 2025. ExxonMobil and Qatar Energy already signed FIDs on the Golden Pass LNG project under development in Texas in 2019, and a plethora of other projects are in varying stages of construction, planning or permitting along the coast of Texas and Louisiana.

But some of these projects may face roadblocks in obtaining capital in the short-term amid an uncertain long-term lending environment, according to US ship brokerage Poten & Partners.

“Elevated geopolitical risk due to the Ukraine crisis and inflation issues all play into an uncertain environment that affects base rates,” said Melanie Lovatt, finance advisor for LNG research reports at Poten. ” A higher base rate plus a [lending] margin means higher all-in pricing for borrowers.”

Inflation has led central banks, led by the US Federal Reserve, to pull back on quantitative easing and hike benchmark interest rates in 2022, raising investment banks’ lending costs in the process. Higher lending rates are likely complicating financing for LNG projects, as with other industries, according to Lovatt.

Uncertainty in bond markets, a key source of refinancing for the industry, is also challenging LNG developers, with one company pulling back this week from a high-profile planned bond sale. Shares in export developer Tellurian dropped sharply on Sept. 20 after the developer of the proposed Driftwood LNG terminal in Louisiana nixed a planned debt issuance, citing “uncertain conditions in the high-yield market.”

“Uncertainty about what the Fed is going to do has created havoc in the debt market and we were faced with doing a deal that would jeopardize the balance sheet of the company, so we decided to pull [the offering],” Tellurian Executive Chairman Charif Souki said on social media Sept. 20, adding that the company’s target for a 2026 startup at Driftwood LNG is in peril as it looks for an equity partner in the project.

Market-wide uncertainty could have a chilling effect on deals, as high lending costs may be complicating commercial discussions around sale and purchase agreements and tolling agreements LNG developers often leverage to secure financing for projects.

“These increased costs are forcing developers to put upward pressure on LNG prices in their discussions with customers, especially when they’re also facing other cost pressures,” Lovatt said.

Environmental concern

US LNG developers have in recent months announced a host of new SPAs, with European majors and Chinese buyers among those vying for present and future supplies amid an uncertain supply outlook stemming from war in Ukraine. But enduring concerns over the true climate benefit of LNG — cleaner than coal but higher-polluting compared to renewables — are creating a two-pronged effect on LNG development, according to experts with Poten. Banks, increasingly focused on funding projects aligned with energy transition goals, are maintaining careful scrutiny of LNG projects in financing discussions, prompting developers to consider costly investments in carbon capture, emissions controls and feedgas processing improvements.

“With all these inflationary pressures, as well as carbon capture, and nitrogen removal [from gas], you have more costs that these projects have to build into their forecasts,” Poten Editorial Manager Sophie Tan said Sept. 21. “[Rising] US LNG contract prices still remain capped by competition, but not by much.”

Tan estimates contracted volumes in long-term SPAs in the US LNG market have been pushed up my as much as 25-30 cents/MMBtu due in part to inflationary and operational cost increases occurring this year, with rising environmental compliance considerations helping lift costs for developers.

Cheniere’s recent experience with US environmental regulation offers one example of an LNG developer dealing with rising costs related to emissions at its terminals. The US’ biggest LNG exporter likely faces higher costs due to the US Environmental Agency’s decision earlier this month to enforce Clean Air Act emissions regulations over uniquely designed gas-fired turbines at the company’s LNG facilities in the US Gulf Coast.

Outlook strong despite hurdles

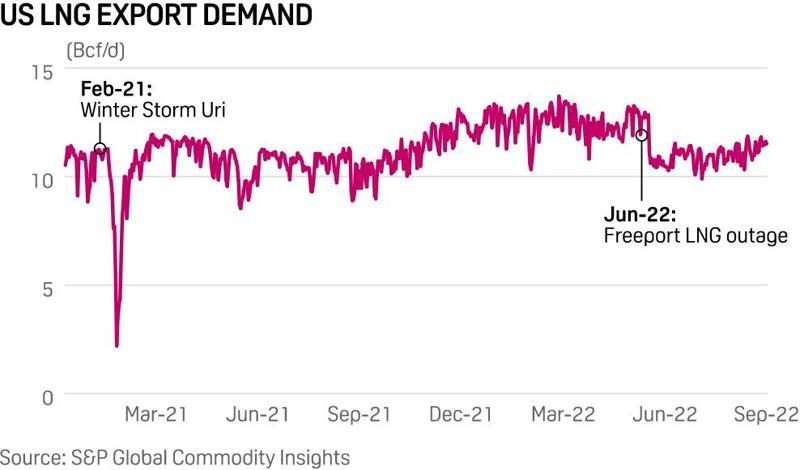

Despite challenges and increased costs faced by LNG projects in the US, the outlook for these projects still looks bright considering demand forecasts. Prior to the outage of the key Freeport LNG export terminal on June 8, feedgas flows to US LNG export terminals had averaged a record-high 12.5 Bcf/d to that point in the year, according to data from S&P Global Commodity Insights. Freeport’s eventual restoration to service and new LNG terminals will likely boost feedgas demand past that figure next year, with S&P Global forecasting US LNG exports at 13 Bcf/d for 2023.

And while commercial discussions supporting new LNG projects may become increasing complicated due to uncertainty on a number of fronts, those discussions remain robust, according to Poten’s Tan.

“The main question that I kept getting from our clients in the past were, ‘Who are the customers?”” Tan said. “Now, they’re all coming out of the woodwork.

“As long as they feel that your project is credible and you have a higher chance of getting to the final investment decision, buyers look for you now.”